Effective Strategies for Managing Debt While on Furlough: A Comprehensive Guide

Effective Strategies for Managing Debt While on Furlough: A Comprehensive Guide

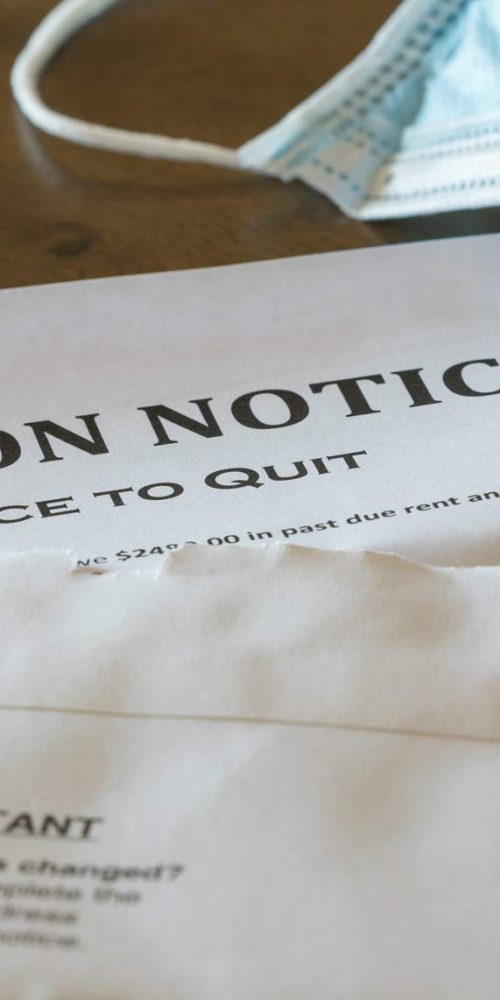

The unprecedented impact of the COVID-19 pandemic has led to significant alterations in the UK economy, resulting in numerous furloughs and substantial job losses in various industries. Many individuals are now facing financial strain, particularly when it comes to managing their debts amidst a considerable decline in income. If you are currently furloughed and receiving only 80% of your regular salary, it can be daunting to tackle debt. Nevertheless, with a solid financial strategy and proactive management, you can overcome these challenges. This guide will provide you with actionable steps to regain control of your finances and work towards a more secure financial future.

1. Create a Customized Monthly Budget to Adapt to Your New Income Level

Begin by developing a revised monthly budget that accurately reflects your current financial situation. This budget should take into account your reduced income and aim to identify areas where you can save money. Assess your spending habits and consider reallocating funds from discretionary categories, like entertainment and dining out, to cover essential expenses. By focusing on your primary financial responsibilities and minimizing non-essential spending, you can create a feasible budget that not only helps you manage existing debts but also prepares you for any future financial challenges that may come your way.

2. Seek Additional Income Streams to Offset Your Reduced Salary

In light of your 20% pay cut, it is crucial to explore alternative income sources that can help you stay on track with debt repayments. Look into part-time job opportunities, freelance gigs, or the gig economy to supplement your income. Additionally, consider trimming your expenses by canceling unused subscriptions or finding more cost-effective grocery shopping strategies. Implementing a budget-friendly meal plan can significantly cut down your monthly food costs. By diversifying your income and minimizing expenses, you can better manage your debt obligations and maintain financial stability throughout your furlough period.

3. Investigate Debt Consolidation Loans for Simplified Repayment Solutions

Consider the possibility of applying for debt consolidation loans for bad credit, which can streamline your repayment process by combining multiple debts into a single, manageable monthly payment. This option can simplify your financial life by reducing the number of due dates and payment amounts you need to keep track of, making budgeting more straightforward. For those in furlough, a <a href="https://ad4sc.com/good-debt-and-its-potential-financial-benefits/">debt consolidation loan</a> offers a structured method for handling limited income while alleviating the stress often associated with juggling multiple payments, ultimately assisting you in regaining your financial footing.

4. Set Long-Term Financial Goals to Enhance Your Future Security

As you work through your current financial hurdles, take the opportunity to reflect on your long-term goals, such as buying a home or starting a business. Defining these aspirations can provide motivation to improve your financial situation. A debt consolidation loan can also positively impact your credit score over time, increasing your chances of qualifying for favorable mortgage or business loan terms in the future. By strategically planning and focusing on your financial objectives, you can forge a path toward greater financial independence and success as you progress forward.

If you need further assistance or expert guidance on managing your finances during these challenging times, and to discover how debt consolidation loans can support furloughed individuals, reach out to Debt Consolidation Loans today for personalized assistance.

If you own a home or business, contact the specialists at Debt Consolidation Loans today to find out how a debt consolidation loan can improve your financial well-being and overall stability.

If you think a Debt Consolidation Loan fits your financial needs, don't hesitate to reach out or call 0333 577 5626. Take the vital first step toward enhancing your financial situation with a single, manageable monthly payment.

Essential Financial Resources for Expert Guidance and Support on Debt Management:

Consolidate My Medical Loan: Is It Possible?

Consolidate My Medical Loan: Is It Possible?

Can You Successfully Consolidate Your Medical Loan? Explore Viable Options

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Postponed Until March: Critical Information You Must Know

Get Out of Debt Quickly: Effective Strategies to Consider

Get Out of Debt Quickly: Effective Strategies to Consider

Proven Strategies for Rapidly Overcoming Debt

Debt Consolidation Loans UK: Benefits and Drawbacks

Debt Consolidation Loans UK: Benefits and Drawbacks

Evaluating the Advantages and Disadvantages of Debt Consolidation Loans in the UK

Debt Consolidation Loan Calculator for Smart Financial Planning

Debt Consolidation Loan Calculator for Smart Financial Planning

Enhance Your Financial Decision-Making with Our Debt Consolidation Loan Calculator

The Article Furloughed and in Debt? Key Actions You Must Take Was Found On https://limitsofstrategy.com

The Article Furloughed and in Debt? Essential Steps to Take Now First Appeared ON

: https://ad4sc.com